The Best Time to Buy and Sell a Home

/Have you ever heard that Spring is the best time to sell a home? While there are certainly seasonal patterns in the greater Cincinnati real estate market just like most places, the main thing to consider is what the situation is when you are ready to sell or buy. Timing does matter, but having a good strategy for the season you’re in matters more!

March to May: More Inventory, More Competition

Due in part to school calendars, better weather, and corporate relocations, Spring is still the most popular time of year to see new homes come up for sale. You’ll see this pattern most dramatically in high demand school districts, because many families find it easier to make a move when their children are out of school for the summer. For sellers, this can mean that you are competing against more listings, so it can be tough to stand out; you’ll want a solid agent advising you on pricing, presentation, and negotiations to make sure you achieve your goals.

Buyers know this pattern if they’ve been watching the market for a little while, and they know it will mean more options to choose from, but also multiple offer situations due to the large number of competing buyers this time of year. Without strong financing and expert negotiation, it can be tough to win and many Spring shoppers find themselves having to write a few offers before they get under contract. Buyers who need concessions from sellers often have trouble competing in the Spring, but if they’re willing to take on a home that might need some updating or has other issues that their competitors turn down, deals can still be made!

June to August: Still Active, More Pressure

As schools start to close for the summer, there are usually still plenty of homes on the market, but this starts to change over the summer. Many buyers start to feel that they’re under more pressure to find the right home before school starts up again, and sellers start to worry that they’ll run out of time as well while watching other homes go pending. Plus, many families choose summer for their family vacations, so between being out of town and coordinating summer sports activities, it can be more challenging to get to the right house at the right time.

On the upside, most homes show their best in the summer! Sellers should focus more than ever on their curb appeal and landscaping during this time. Buyers normally see a little less competition by this point in the year, and they often have a little more time to make a decision. This can mean more contracts staying together than during busier times.

September to November: More Opportunities

Autumn traditionally brings fewer new listings to the market, and homes tend to stay on the market longer which usually results in more price reductions than other seasons. Sellers during this time are usually more motivated, and since some Buyers have decided to hold off until the next year by this point, Buyers should see less competition overall. This particularly benefits move-up Buyers who need to sell their current home in order to buy the next one, property investors who can more easily pick out the homes that aren’t appealing in their current state to the rest of the buyer pool, and first time buyers who might not have been as attractive to sellers earlier in the year.

December to February: Less Volume, More Intent

If there’s one rule about winter, it’s that anyone who’s buying or selling during this time is likely to be very motivated. There’s less daylight to see homes, colder temperatures, and lots of holiday activities to juggle on the calendar. Most homes don’t look as pretty without leaves on the trees, and snow is only charming to a point. Sellers can expect serious buyers during the winter who really want or need to move, perhaps due to hating their rental, job relocation, or other life events. Buyers won’t have as much competition in the marketplace, but they’ll also have less to choose from so it’s not the ideal season to be picky.

Winter is a great time to reach out to your agent, though, if you are considering making a move in the next 12 months. Sellers will have more time to get an idea of their home’s current and projected resale value, professional input on what improvements might be worth the money, and which season might be best for their particular neighborhood and situation. Buyers can start casually viewing homes for sale, and first timers especially can use this time as a learning period to see what types of homes they might like, what some common areas of concern might be, and which homes sell faster than others — while at the same time continuing to save for their down payment, or improving their credit to put themselves in a better position when they find the right home.

Should You Time the Market?

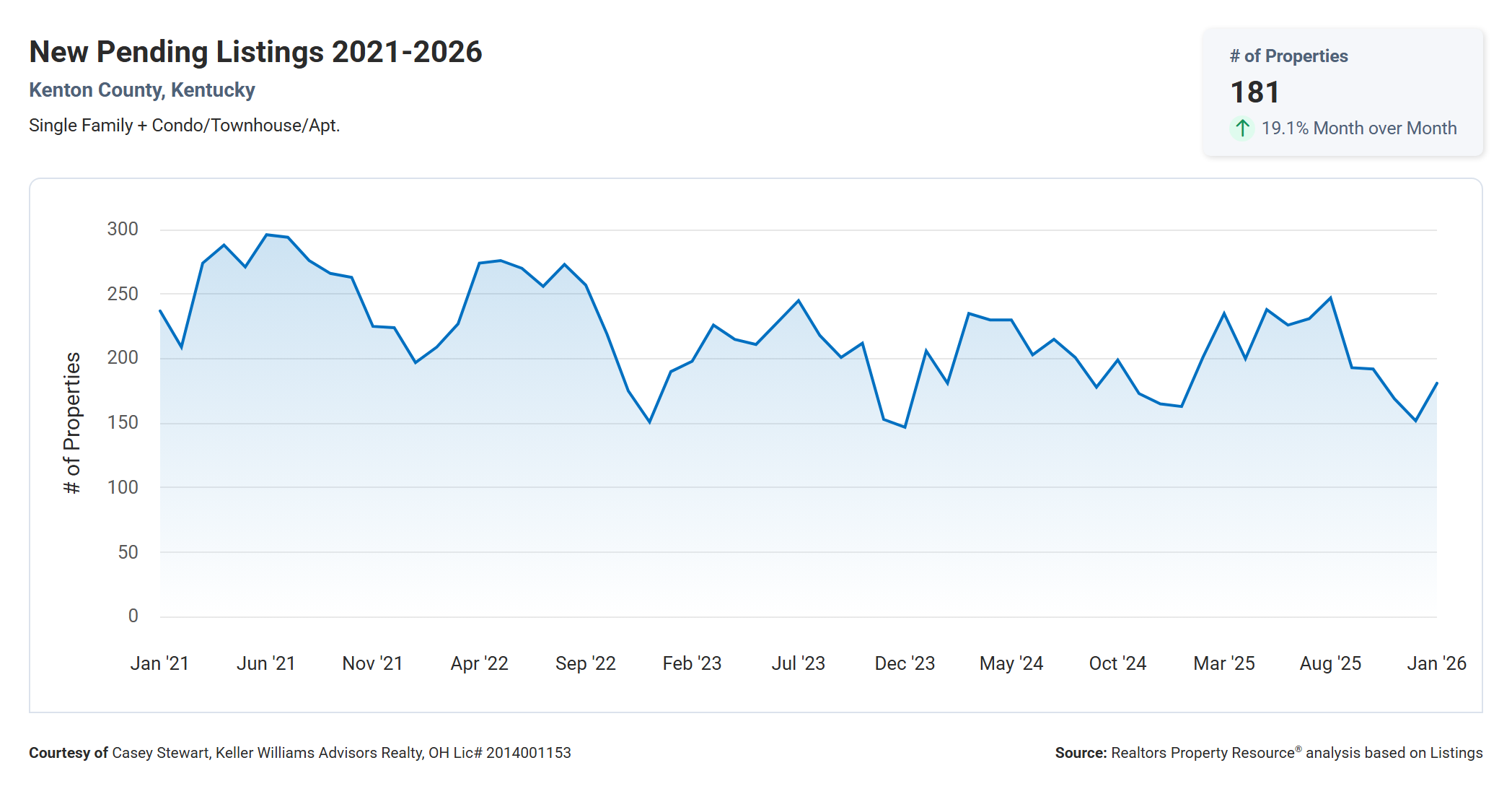

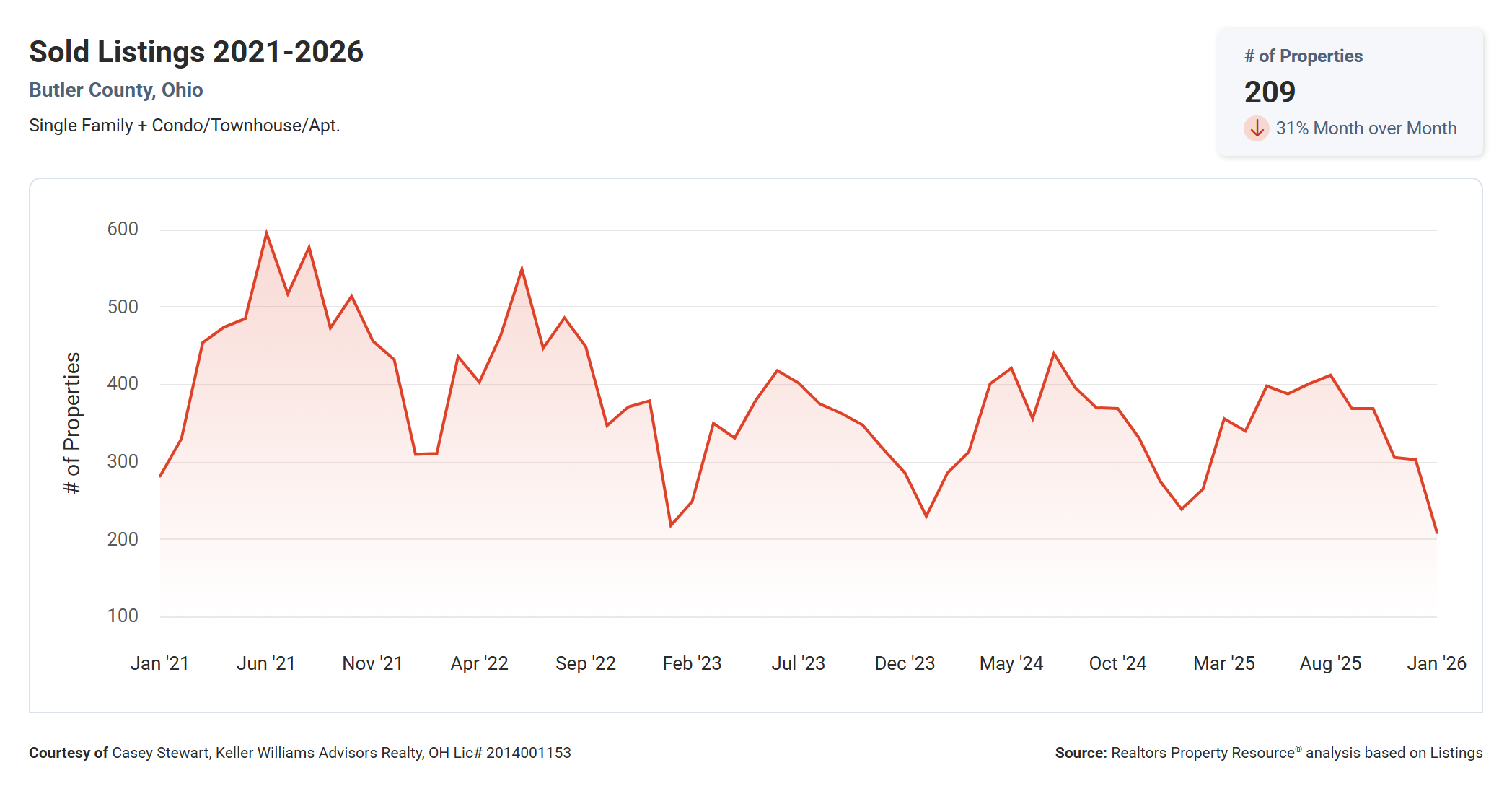

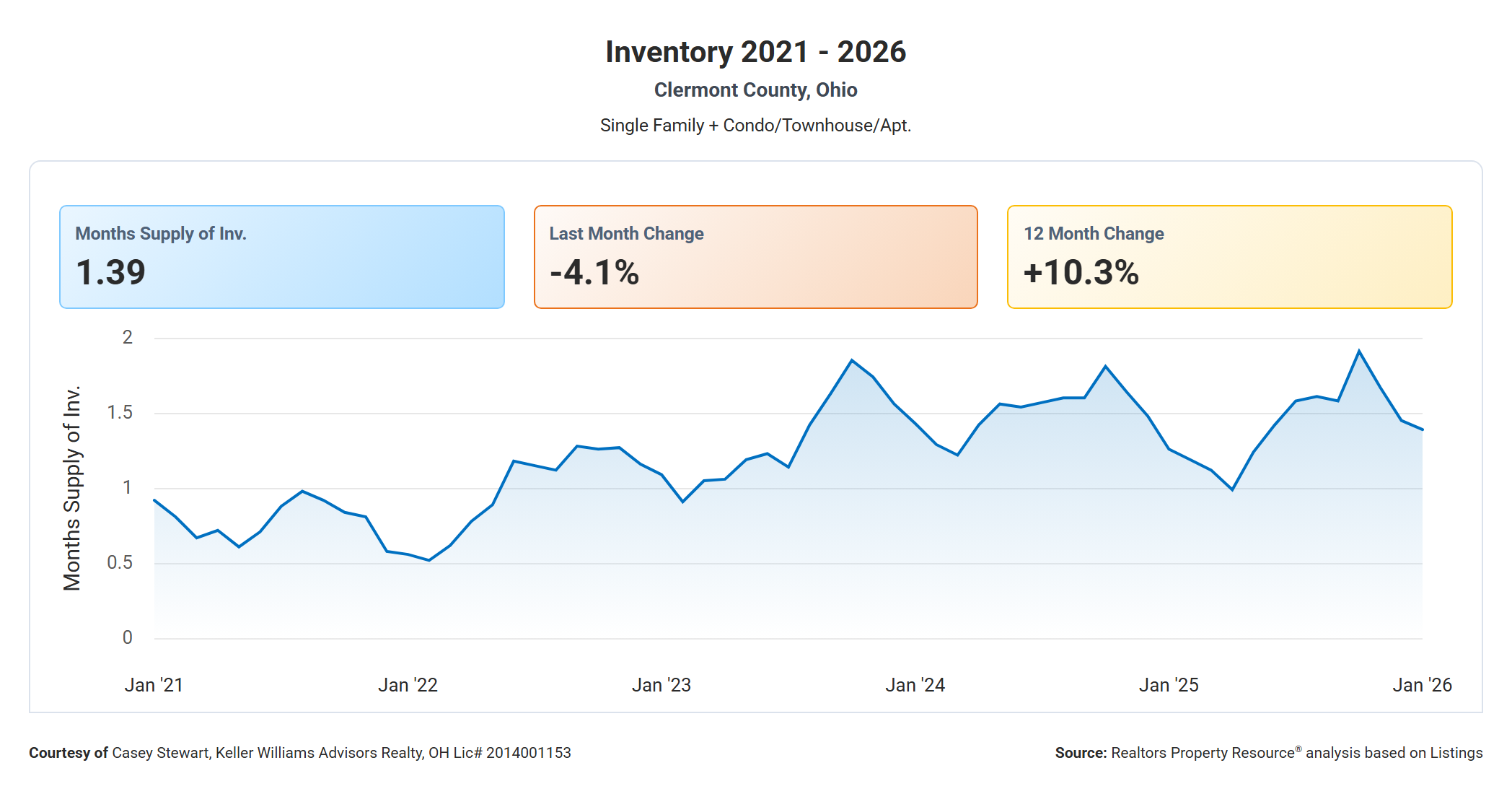

You can see in the charts above that these trends seem to be true throughout greater Cincinnati (each one pulled data from a different county), but keep in mind that this can vary on a micro level: urban, suburban, and rural markets all function a little differently, which is why it’s so important to review your specific situation with a great agent. Your price range, school district, and percentage of investors to owner-occupants can also affect market activity and timing, not to mention national factors such as mortgage rates and economic or political uncertainty.

My personal feeling is that the best time to sell your home is when you’re ready to sell: when you’ve made all the improvements you are willing and able to make, when you’re financially and emotionally ready for the change, and when you have a solid plan. The same concept applies to buyers! If you are financially prepared to buy a home, and homes in that price range align with your goals, it’s time to start looking.